12 Elimatta Place, Kiama, NSW 2533

Elimatta Place, Kiama NSW 2533, Australia

![104200066ml1186476002[1]](https://bprerealestate.com.au/wp-content/uploads/2014/06/104200066ml11864760021-800x323.jpg)

![104197534hl1186400030[1]](https://bprerealestate.com.au/wp-content/uploads/2014/06/104197534hl11864000301-800x323.jpg)

![104200066gl1186475150[1]](https://bprerealestate.com.au/wp-content/uploads/2014/06/104200066gl11864751501-800x323.jpg)

![104197534fl1186400028[1]](https://bprerealestate.com.au/wp-content/uploads/2014/06/104197534fl11864000281-800x323.jpg)

![104200066bl1186475146[1]](https://bprerealestate.com.au/wp-content/uploads/2014/06/104200066bl11864751461-800x323.jpg)

Elimatta Place, Kiama NSW 2533, Australia

Overview

|Description

Kiama Place

Project Description

Positioned on the last 15,000sqm of land in the heart of Kiama, Kiama Place is a truly unique development blending luxury, location and lifestyle.Consisting of 32 torrens title duplex’s, the site is nestled amongst stunning landscape, with its natural surrounds and spectacular Riparian Corridor masterfully incorporated into the design.

Encompassing both one and two storey dwellings, each with 4 to 5 bedrooms, lock-up garages and private gardens, Kiama Place makes the ultimate seaside address.

Showcasing a sleek, contemporary design, each dwelling boasts alfresco entertaining areas, luxe master ensuites and free-flowing living spaces of exceptional class and finish. Awash in natural light and with beautiful timber floorboards throughout the living areas, each duplex creates a sanctuary of space and sophistication. Setting new standards of living for Kiama, you can guarantee that the whole family will enjoy coming home.

Located just 500m to the beach, Kiama Place offers residents a coveted coastal lifestyle where fresh sea breezes and a quieter pace of life are assured. Ideally positioned just 5-minutes to Kiama Station and 10-minutes to the town centre, Kiama Place offers its residents every convenience. Live an active life with a choice of three local golf courses, lawn bowls, tennis clubs, fitness and recreational centres at your fingertips. For families there’s a local primary school and high school, Catholic school and day care facilities. With 15 vineyards, fishing, fine seafood dining and seven magical beaches along the Shoalhaven Coast, there’s something for everyone to enjoy.

Kiama booms as buyers outnumber sellers

Nestled amongst rolling green hills and stretches of white sandy beach, the seaside town of Kiama offers a magical setting where coast and country meet. Boasting stunning natural attractions and plenty of rural charm, this idyllic NSW South Coast setting is located just a 90-minute drive to Sydney and 30-minutes from Wollongong.

Highlights

- Sea side town

- Rural setting

- Tranquility

- Scenic ocean views

- Privacy

- Private outdoor spaces

- 500m to the Beach

- 1000m to Kiama Blowhole

- Short stroll to tennis club

- Station & town centre

- 90-minute drive to Sydney

- 30-minute to Wollongong

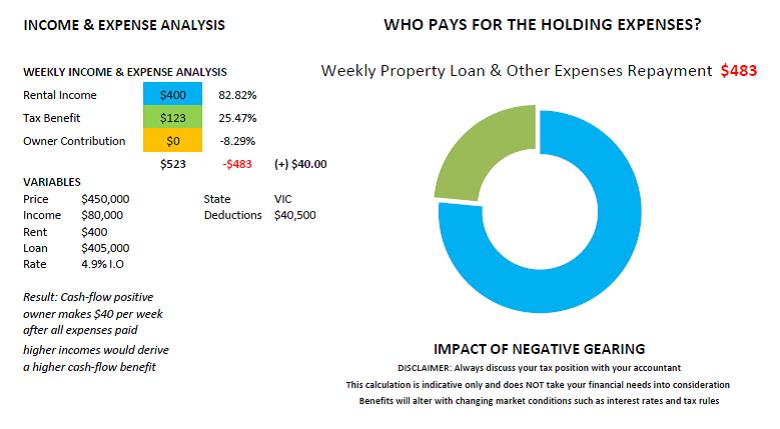

Buying this property for investment?

Below is a snap-shot of the income and expenditure analysis for a property purchase of around $450,000. The investor would actually be in a cash-flow positive position (making around $40.00 per week) after Negative Gearing benefits are taken into consideration. The benefits will change based on your income, interest rates, loan term, depreciation, general property expenses and other market conditions.

Customise your calculation by using our Negative Gearing Tax Simulator – input your actual income and proposed purchase price. Please read the Disclaimer and Explanatory notes before use.

Negative Gearing Tax Simulator

Additional Details

- Configuration: 4 Bedrooms

- Property Price: $635,000

- Estimated Rental: $600 to $700 Per Week

- Building Status: Construction Completion December 2015

Features

Property Attachments

-

gallery8

110.65 kb -

interior-one-770×386

51.92 kb -

gallery9

171.04 kb -

slide-two

295.10 kb -

slide-one

344.83 kb -

284.10 kb -

property-large-12

37.91 kb -

property-large-4

39.50 kb -

logomc

39.26 kb -

rainbowlogoblack2

28.26 kb -

104200066ml1186476002[1]

71.10 kb -

slidenew

100.57 kb -

beautiful_house-wallpaper-1920×1440-1920×664

304.10 kb -

156.02 kb -

Lounge Room 5

66.90 kb -

Main Bathroom 1

84.00 kb -

sailing

129.98 kb -

Man pointing something to his partner on screen in creative office

156.02 kb -

Main Bedroom 2

84.99 kb -

Kitchen 1

60.16 kb -

104197534hl1186400030[1]

97.19 kb -

Dining Room 2

83.36 kb -

Dining 2

70.62 kb -

104200066gl1186475150[1]

66.01 kb -

104197534fl1186400028[1]

75.10 kb -

104200066bl1186475146[1]

75.20 kb -

overheadvideo2

1.81 mb -

image9

93.00 kb -

main (1)

70.91 kb -

image2

59.10 kb -

image3

57.92 kb -

image4

62.37 kb -

image5

65.60 kb -

image6

64.38 kb -

image7

83.09 kb -

image8

38.80 kb -

main

108.45 kb -

image2

100.04 kb -

116.68 kb -

image4

97.51 kb -

image5

100.64 kb -

image6

108.92 kb -

image7

85.17 kb -

image8

53.71 kb -

image9

62.21 kb -

image10

65.85 kb -

ok2

20.28 kb -

luxury_house_2-wallpaper-1920×1200-770×469

137.27 kb -

sailing

146.31 kb -

affiliatenetwork

58.22 kb -

Lenovo

38.97 kb -

Couple on computer

245.09 kb -

slide5

617.64 kb -

slide7

588.11 kb -

slide6

1.18 mb -

slide1

781.25 kb -

slide9

890.88 kb -

Project181_2

406.08 kb -

Project181_3

57.75 kb -

Project181_4

87.47 kb -

Project181_6

99.78 kb -

Project181_7

75.32 kb -

Project181_9

62.79 kb -

Project181_10

81.61 kb -

rotation01a

256.96 kb -

rotation01b

156.63 kb -

rotation01e

226.59 kb -

rotation03

207.85 kb -

rotation07

263.40 kb -

investInAus

103.05 kb -

shutterstock_172529408_2000px-1600×540

279.97 kb -

Property News

421.51 kb -

279.49 kb -

brooklyn1

34.87 kb -

brooklyn2

34.85 kb -

brooklyn4

34.17 kb -

brooklyn5

40.65 kb -

brooklyn6

51.26 kb -

brooklyn7

30.60 kb -

brooklyn8

55.47 kb -

brooklyn9

46.75 kb -

brooklyn10

57.82 kb -

brooklyn11

46.85 kb -

metro-prop-logo

18.49 kb -

logo_rpdata

18.20 kb -

australand_logo_new

12.56 kb -

niche

1.96 kb -

Developer_190_ProfileImage

13.33 kb -

Developer_183_ProfileImage

17.38 kb -

Developer_184_ProfileImage

16.30 kb -

DevMain_148_ProfileImage

14.44 kb -

Developer_100_ProfileImage

17.92 kb -

BPRE icon-property-search

4.50 kb -

BPREsearchorange

16.73 kb -

governor1

73.01 kb -

governor2

112.93 kb -

governor3

71.87 kb -

governor5

75.97 kb -

BPRElogosv2

28.36 kb -

search-icon

1.98 kb -

BPREdrummoyne

30.10 kb -

enmore1

1.62 mb -

enmore2

359.10 kb -

enmore3

896.12 kb -

enmore4

653.52 kb -

enmore5

751.28 kb -

enmore6

170.42 kb -

searchtest

20.46 kb -

searchtest1

57.13 kb -

searchtest3

41.54 kb -

searchtest5

51.68 kb -

searchtest6

51.68 kb -

searchtest7

56.49 kb -

mapblue

70.07 kb -

maporange

69.26 kb -

waterloo1

102.50 kb -

waterloo2

98.74 kb -

waterloo3

93.00 kb -

waterloo4

80.96 kb -

waterloo5

139.42 kb -

waterloo6

701.89 kb -

waterloo7

243.76 kb -

waterloo8

242.42 kb -

waterloo9

196.93 kb -

waterloo10

415.99 kb -

waterloo11

376.79 kb -

waterloo12

417.57 kb -

waterloo13

656.20 kb -

waterloo15

314.36 kb -

waterloo16

206.92 kb -

next

12.81 kb -

mapblueb

69.79 kb -

maporangeb

49.08 kb -

mapblueb

49.63 kb -

vbycrown1

105.22 kb -

vbycrown3

85.28 kb -

vbycrown4

100.16 kb -

vbycrown5

66.37 kb -

vbycrown6

81.77 kb -

vbycrown7

53.48 kb -

vbycrown8

59.99 kb -

vby9

126.29 kb -

vbycrown10

294.95 kb -

vbycrown11

282.27 kb -

vbycrown12

100.16 kb -

vbycrownm

286.06 kb -

Sydney Skyline

207.41 kb -

Sydney Skyline 2

310.35 kb -

Sydney Skyline

328.66 kb -

Sydney Skyline 2

355.20 kb -

Dinning area

1.98 mb -

Bedroom

186.07 kb -

Living room 33

233.36 kb -

villa sea

91.56 kb -

Villa

91.83 kb -

Balloons

59.38 kb -

Birsbane

229.31 kb -

quote-730×365

2.19 kb -

75.78 kb -

Computer nerd

211.07 kb -

commasr

18.20 kb -

com

1.45 kb -

1 million median value

83.31 kb -

Girl Happy

71.07 kb -

Idea image

216.46 kb -

fridge

242.88 kb -

data

182.73 kb -

icon_arrow

15.12 kb -

Tell me

128.03 kb -

Presentation

174.91 kb -

Bedroom 6

661.78 kb -

Couple

174.63 kb -

house new

132.80 kb -

Living room 6

662.51 kb -

Man thinking

93.56 kb -

BPRE slider image

152.04 kb -

Back house

375.05 kb -

478.71 kb -

Lion-Colourful

661.72 kb -

Rainbow Kid

260.83 kb -

wh8

655.06 kb -

imac

196.62 kb -

Penthouse1

162.08 kb -

Stats

45.37 kb -

Bedroom4

325.42 kb -

affiliatenetwork

62.94 kb -

Webjet

75.86 kb -

S

137.51 kb -

BPRE banner 1

36.90 kb -

937063-1_l

50.41 kb -

family 1

1.36 mb -

bprehomeloan

75.37 kb -

Sky full of balloons in Cappadocia

414.40 kb -

BPRElogosv3

28.52 kb -

Project832_2

69.33 kb -

Project832_3

29.34 kb -

Project832_4

37.04 kb -

Project832_5

45.28 kb -

Project832_6

61.17 kb -

Project279_3

275.53 kb -

Project279_4

225.53 kb -

Project279_5

204.74 kb -

Project279_6

211.68 kb -

Project279_7

191.21 kb -

Project279_2

269.79 kb -

Project279_9

288.24 kb -

Project279_10

272.20 kb -

Beach

131.34 kb -

Project841_2

71.62 kb -

Project841_3

44.72 kb -

Project841_4

32.02 kb -

Project841_5

41.72 kb -

Project841_6

37.54 kb -

Project411_2

95.16 kb -

Project411_3

120.37 kb -

Project411_4

106.76 kb -

Project411_5

108.76 kb -

Project411_6

119.68 kb -

Project411_7

107.52 kb -

Project411_10

54.65 kb -

Project411_9

72.95 kb -

Project401_2

73.17 kb -

Project401_3

84.11 kb -

Project401_4

111.94 kb -

Project751_2

67.21 kb -

Project751_3

70.34 kb -

Project751_4

59.88 kb -

Project751_5

55.13 kb -

Project286_2 (3)

405.25 kb -

Project286_3

315.68 kb -

Project286_4

583.52 kb -

453.62 kb -

Project286_6

369.72 kb -

Project286_7

196.60 kb -

12

818.34 kb -

Project_118_Image2

403.68 kb -

Project118_2

403.67 kb -

Project118_3

234.21 kb -

Project118_4

444.19 kb -

Project118_5

358.87 kb -

Project118_6

367.68 kb -

Project705_3

78.44 kb -

Project705_2

56.71 kb -

Project705_4

65.21 kb -

Project705_5

105.39 kb -

Project93_2

514.08 kb -

Project93_3

386.17 kb -

Project93_4

441.71 kb -

Project93_5

247.41 kb -

Project93_6

417.47 kb -

Project93_7

513.10 kb -

Project850_2

413.14 kb -

Project850_3

247.58 kb -

Project850_4

240.35 kb -

Project850_5

248.31 kb -

Project850_6

85.55 kb -

Project850_7

85.45 kb -

Autumn-bathroom_Final

43.39 kb -

Autumn-Kitchen_Final

92.46 kb -

Autumn-living_Final

90.83 kb -

Exterior-Aerial

179.64 kb -

Winter-Garden_Final

105.91 kb -

zen-garden-2_Final

73.81 kb -

spring-bathroom_Final

58.04 kb -

Project787_2

55.71 kb -

Project787_3

49.25 kb -

Project787_4

38.01 kb -

Project787_5

38.18 kb -

Project852_6

64.52 kb -

Project230_2

93.96 kb -

Project230_3

411.38 kb -

Doreen – living

340.13 kb -

A9RB713

244.77 kb -

A9RB716

333.74 kb -

A9RB719

253.52 kb -

A9RB71C

282.38 kb -

A9RB721

106.40 kb -

A9RB724

79.53 kb -

Project710_3

97.22 kb -

Project710_2

87.38 kb -

Project710_4

79.85 kb -

A9RF0AE

66.79 kb -

A9RF0B3

56.78 kb -

66.98 kb -

Project105_3

326.40 kb -

Project105_4

253.48 kb -

A9RBD2C

97.49 kb -

134.69 kb -

bathroom

95.36 kb -

242.57 kb -

kitchen

118.25 kb -

bathroom

75.15 kb -

Project802_3

51.99 kb -

Project802_4

53.15 kb -

Project802_5

75.51 kb -

Project802_6

48.12 kb -

Project113_2

306.45 kb -

179.02 kb -

Project113_4

201.96 kb -

Project113_5

108.35 kb -

floorplan

1.34 mb -

Table1

16.62 kb -

141021_-_income_from_property

23.83 kb -

Project849_3

37.01 kb -

Project849_4

32.34 kb -

Project849_5

28.44 kb -

A9RD096

226.40 kb -

Plans 1

76.22 kb -

Plan 2

51.18 kb -

Map1

60.21 kb -

BPRE

104.83 kb -

collection logo small

25.95 kb -

collectionfooter

24.58 kb -

Beach Box 2

70.18 kb -

Floor plan1

35.84 kb -

Floorplan2

37.36 kb -

Project838_2

59.13 kb -

Project838_3

59.73 kb -

Project838_4

51.26 kb -

Project838_5

74.63 kb -

Project838_7

67.70 kb -

Beach Box 47

64.75 kb -

Chart1

36.06 kb -

Chart1

37.72 kb -

Chart1

44.31 kb -

Board1

94.49 kb -

bprebanner1

171.28 kb -

slide5

395.23 kb -

slide7

444.58 kb -

Cyrian – Project1017_2

78.29 kb -

Project1017_3

67.10 kb -

Project1017_4

46.96 kb -

Project306_2

47.19 kb -

Project306_3

44.86 kb -

Project306_4

39.37 kb -

Project306_5

43.80 kb -

Project306_6

45.94 kb -

Project306_7

38.91 kb -

Project306_9

90.77 kb -

Project306_10

64.93 kb -

271.80 kb -

Project933_3

351.10 kb -

Project933_4

237.23 kb -

Project933_5

261.59 kb -

Project933_6

289.97 kb -

Project933_7

252.50 kb -

Project933_9

216.04 kb -

Project933_10

265.19 kb -

Project1099_2

313.55 kb -

Project1099_3

222.62 kb -

Project1099_4

178.36 kb -

Project1099_5

258.21 kb -

Manderlay,_Lane_Cove

354.85 kb -

Woodfordbaylane_cove_new_south_wales

380.29 kb -

Manly beach

176.05 kb -

Manly_beach

61.89 kb -

Belle

80.01 kb -

Project288_2

75.43 kb -

Project288_3

337.59 kb -

Project288_4

181.14 kb -

Project288_5

237.46 kb -

Project288_6

47.97 kb -

Map

38.54 kb -

Map

35.49 kb -

bprelogogeneral

21.06 kb -

bprelogofooter

20.62 kb -

bprelogomybankfooter

20.93 kb -

bprelogomybankfooter

22.08 kb -

Meeting business

85.84 kb -

92.49 kb -

318.02 kb -

Main Front Image

341.54 kb -

361.74 kb -

Project1158_4

357.47 kb -

Floor Plan

76.11 kb -

Floor Plan 3

85.75 kb -

Floor Plan1

78.02 kb -

slide3

330.72 kb -

goldcoast1

57.90 kb -

goldcoast2

46.59 kb -

goldcoast3

74.87 kb -

goldcoast4

35.17 kb -

WaterPoint H type Levels 1-13

363.53 kb -

WaterPoint G type Levels 2 – 13

384.34 kb -

WaterPoint D type Levels 1-13

339.11 kb -

WaterPoint C type Levels 1-13

350.21 kb -

goldcoast6

315.32 kb -

goldcoast7

237.99 kb -

goldcoast8

197.68 kb -

goldcoast9

216.44 kb -

goldcoast10

147.15 kb -

goldcoast11

366.17 kb -

goldcoast12

306.72 kb -

goldcoast13

355.84 kb -

goldcoast15

248.67 kb -

goldcoast16

286.14 kb -

goldcoast17

209.90 kb -

goldcoast18

254.62 kb -

goldcoast19

242.26 kb -

9 Wrights Road plan a

110.69 kb -

9 Wrights Road plan b

119.58 kb -

9 Wrights Road plan c

158.39 kb -

9 Wrights Road plan d

161.48 kb -

9 Wrights Road plan e

127.72 kb -

9 Wrights Road plan f

166.27 kb -

9 Wrights Road plan g

152.06 kb -

9 Wrights Road plan k

123.65 kb -

9 Wrights Road plan l

155.67 kb -

9 Wrights Road 1

241.53 kb -

9 Wrights Road 2

1.15 mb -

9 Wrights Road 3

277.46 kb -

9 Wrights Road 4

948.29 kb -

9 Wrights Road a

293.61 kb -

9 Wrights Road b

284.15 kb -

9 Wrights Road c

323.12 kb -

9 Wrights Road me

252.48 kb -

9 Wrights Road plan ground floor

160.07 kb -

9 Wrights Road plan first floor

119.43 kb -

9 Wrights Road plan ground2

150.59 kb -

9 Wrights Road plan second floor

126.01 kb -

9 Wrights Road plan roof level

86.01 kb -

backtop

53.39 kb -

backtop

132.28 kb -

UNDER-OFFER-Red

10.30 kb -

635a

132.60 kb -

636a

162.54 kb -

637a

149.63 kb -

13919136_1a

91.46 kb -

13919136_3a

157.51 kb -

13919136_4a

139.79 kb -

19480176_1a

81.90 kb -

19480176_2a

104.89 kb -

19480176_3a

75.29 kb -

23794067_1a

106.25 kb -

23794067_2a

81.92 kb -

23794067_3a

69.08 kb -

23794067_4a

98.04 kb -

23794067_5a

108.45 kb -

23794067_6a

146.07 kb -

23794067_7a

139.44 kb -

facilities

204.70 kb -

foyer

123.95 kb -

kitchen

105.50 kb -

outside

165.08 kb -

sunroom

162.66 kb -

sussex1

91.80 kb -

sussex3

130.97 kb -

sussex4

130.98 kb -

141.10 kb -

view

144.85 kb -

view2

289.82 kb -

sussex4

115.93 kb -

tall

140.11 kb -

view2

244.88 kb -

23794067_5a

108.45 kb -

23794067_6a

146.07 kb -

23794067_7a

139.44 kb -

facilities

184.20 kb -

foyer

110.62 kb -

outside

149.60 kb -

13919136_3a

157.51 kb -

19480176_1a

81.90 kb -

19480176_2a

104.89 kb -

19480176_3a

75.29 kb -

floorplanrevisednew

488.88 kb -

bossleypark1

376.39 kb -

bossleypark2

133.95 kb -

bossleypark3

286.09 kb -

bossleypark4

146.47 kb -

bossleypark5

185.73 kb -

bossleypark6

275.61 kb -

bossleypark8

332.77 kb -

bossleypark9

122.76 kb -

bossleypark12

105.91 kb -

bossleyparkfloorplan

1.12 mb

Property on Map

What's Nearby?

Food

- Kiama Leagues Club 0.47 km4 Reviews

- Art Bar Kiama 1.48 km2 Reviews

- The Blue Goose 7.32 km1 Reviews

- LEAF 27.26 km2 Reviews

Pets

- Chris's Mobile Dog Wash 0.13 km0 Reviews

- Kiama Veterinary Hospital 0.41 km0 Reviews

- Peto 81.24 km1 Reviews

- Dial a Vet Nurse 1.03 km0 Reviews

Shopping

- MacArthur Square 57.88 km4 Reviews

- Wollongong Central 24.22 km1 Reviews

- Rhodes Shopping Centre 83.09 km1 Reviews

- Westfield Sydney 82.59 km50 Reviews

powered by

Mortgage Repayments Calculator

- Principle and Interest

Similar Properties

CAMPUS at Clayton 1 Gardiner Road, Clayton VIC 3168

CAMPUS at Clayton 1 Gardiner Road, Clayton VIC 3168